Building Audit-Ready Automation: A Complete Guide

|

|

When a company faces an audit, there are typically two types of responses.

The first is flat-out panic, with teams buried in spreadsheets, frantically searching for evidence, and burning the midnight oil to puzzle together a paper trail that never quite adds up.

The second is calm. Everything is traceable, logged, and versioned. It is almost like the system was built with audit readiness as the first brick, accounting for every approval, control, and exception.

This Buddha-like Zen is what audit-ready automation promises.

Building automation that is audit-ready by design is mandatory in today’s world, where speed, transparency, and compliance are vital business requirements. It is a survival skill.

| Key Takeaways: |

|---|

|

What Does It Mean to Be Audit-Ready?

Let’s begin with a simple query before diving into tools or frameworks:

How do you achieve audit readiness?

Being audit-ready means that your organization can show that it has control over its data, processes, and choices at any time. Passing an annual audit is not the ultimate goal; you also need to behave as though the auditor is continuously observing you, and be confident despite that.

Think of it this way: you can swiftly understand who did what, when, under what circumstances, and what was authorized if a specific control fails or a transaction appears suspicious.

An audit-ready process is predictable, repeatable, and verifiable. And automation is the engine that makes it possible.

Automation in Internal Audit: From Checklists to Continuous Controls

In the past, internal audit teams were the unsung heroes who stringently verified each item on checklists and Excel sheets. But that world has now changed.

Organizations can now leverage continuous auditing, or controls that verify for themselves in real time, due to automation in internal audit.

An automation tool can consistently monitor data, flag anomalies, and even trigger alerts for review, ditching the need for spot-check transactions once every quarter.

- Access rights are reviewed and logged weekly rather than annually.

- Journal entries over a certain threshold automatically need dual approval.

- Evidence collection takes place automatically in the background.

This is not the future. Today’s progressive audit teams are using automation to do just that.

Audit Automation Tools and Why They Matter

Organizations can shift from manual controls to automated assurance with the help of a scaling ecosystem of audit automation tools.

- Automatically capture evidence to create tamper-proof trails.

- Standardize processes so that all controls act in the same manner.

- Integrate with business systems, like ERP, CRM, and HR, to pull data straight from the source.

- Save preparation time by generating reports in formats that are simple for auditors to understand.

Robotic process automation (RPA) bots, integrated audit management platforms, and compliance management software are a few instances of automated auditing tools.

The ideal systems help you analyze why something occurred and stop it from happening again, in addition to simply logging what happened.

Is an Audit of Business Process Automation Software Necessary?

It’s absolutely necessary, and the reason is explained below.

Although business process automation (BPA) has many benefits, automating a process also means automating its errors.

If your logic, workflows, or rules contain errors, they will replicate at machine speed. For this reason, it is vital that business process automation software be audited.

- Clear documentation of automated controls.

- Logic testing and validation.

- Audit trails for each automated action.

- Change management and secure access.

To view it in another manner, you need to audit your automation process itself, not just the results it produces.

The correct course of action is to include those controls directly into your automation layer, making them evidence-ready, traceable, and self-checking.

How to Automate an Audit Process

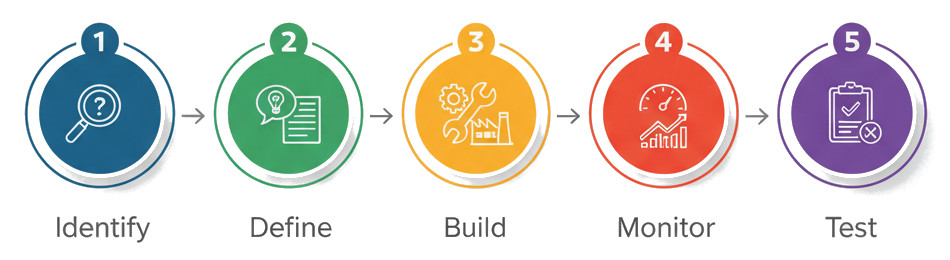

The framework below is one that businesses can use to automate an audit process.

Step 1: Define what is most important

Start by understanding which procedures are necessary for the audit. These usually include vendor management, financial reporting, access controls, and data privacy workflows. It is important to ask what kind of evidence an auditor would want to examine.

Step 2: Define and digitize controls

It is possible to convert any manual condition, such as “manager must approve payments over $10,000,” into automation logic. Uniform enforcement of regulations is ensured by digital workflows.

Step 3: Enable logging and evidence capture

A digital breadcrumb should be developed for each action. This includes: who, what, when, and why. Keep this in a centralized, immutable repository.

Step 4: Integrate with core systems

Integrate automations with the existing HR, ERP, or CRM systems to pull real-time data, always avoiding stale reports, as auditors prefer to view data at the source.

Step 5: Allow continuous monitoring

Build alerts for exceptions or anomalies. The system automatically notifies the right parties when something drifts from the expected.

Step 6: Review, test, and improve

When you start automation, it doesn’t stop there. To ensure controls continue to work as expected, you must test regularly.

What is ATS in Audit?

The term ATS stands for Audit Tracking System, which is most likely to be familiar to anyone who works or has worked in auditing.

- The automation emphasizes the issue when a control malfunctions, such as when an approval threshold isn’t implemented.

- The ATS is directly affected by that issue.

- After that, the system keeps track of timelines, corrective action, and accountability.

Organizations can build a closed feedback loop, i.e., a self-healing audit environment. This is possible by combining ATS data with testing outcomes and automation logs.

The 5 C’s of Audit Finding: and How Automation Strengthens Them

The five C’s of audit findings: condition, criteria, cause, consequence, and corrective action. These are well-known to all auditors.

They function as the base for the reporting and resolution of problems. However, these “C’s” do more than simply describe issues in an automated world. They also help in their prevention. Here’s how audit-ready automation reinforces each one.

Condition: What’s Actually Happening

- The condition defines the current situation, comparing what the auditor discovered to what ought to have occurred.

- Finding this in a manual step may need weeks of backtracking through spreadsheets.

- Automation makes the condition obvious immediately.

- Real-time activity is displayed on dashboards, and all transactions and exceptions are automatically documented.

- The system immediately identifies when an employee bypasses a control or approval threshold, so there are no shocks later on.

The “condition” is converted from a discovery into real-time visibility through automation.

Criteria: What Should Be Happening

- Internal controls, laws, or policies are all instances of criteria. These are the rules or standards that processes must satisfy.

- Compliance is made simple when those regulations are hard-coded into automation logic (for example, “two approvals needed for payments over $10,000”).

- Automation ensures that policies are consistently enforced in the same manner, regardless of how they are written.

That’s how organizations move from reactive compliance to audit-readiness by design.

Cause: Why It Happened

- The cause identifies the underlying cause of a finding. Tracing that path can be like detective work if automation is not leveraged.

- The evidence, including detailed logs, timestamps, and data lineage, is already in automated systems.

- Within seconds, you can identify who caused an authorized action or when a rule failed. Auditors comply with a distinct, traceable trail rather than piecing together clues.

Consequence: Why It Matters

- The risk or impact is explained by the consequence. This is quantifiable rather than theoretical due to automation. The number of affected transactions, their value, and any possible regulatory implications can all be observed through real-time analytics.

- Even downstream effects, like the possible impact of a failed control on financial statements or compliance filings, are forecasted by specific audit automation tools.

It’s a shift from indulging in a guessing game about the impact to immediately quantifying it.

Corrective Action: What We’re Doing About It

This is the stage where findings convert into fixes.

Corrective actions are often ignored in follow-up emails in manual environments. Every discovery can kick off a remediation process with automation, which automatically assigns owners, deadlines, and reminders.

Until closure, progress is observed through integration with an Audit Tracking System (ATS). Better yet, testRigor and other automated testing tools can validate that the fix is efficient. If the control logic is corrected, testRigor runs AI-driven, plain-English tests to confirm and document success, thus creating clean evidence for auditors.

Bringing the 5 C’s Together

Automation is beneficial for each “C” individually. When merged, they offer a living ecosystem of control that detects, records, explains, measures, and fixes itself.

The 5 C’s function as a continuous loop of assurance rather than a post-mortem exercise.

The true benefit of audit-ready automation is that it doesn’t wait for auditors to catch issues. It helps the organization in identifying and resolving them initially.

A Practical Example on How to Build Audit-Ready Automation

Let us use an example to make this more relatable.

Imagine a company called “GoodPay,” a mid-sized fintech business that handles hundreds of vendor payments each month.

- Finance and procurement are exchanging emails like crazy.

- Approvals get buried in overflowing inboxes.

- Spreadsheets that don’t match the data in the system.

- After the implementation of audit-ready automation, the following was observed:

- All payment requests are automatically timestamped and recorded.

- The system checks for invoices to purchase orders and looks for duplicate vendors.

- Approvals above a threshold demand dual authentication.

- All supporting evidence, such as invoices, approvals, and logs, is stored in a single, searchable audit repository.

GoodPay doesn’t panic when audit season comes knocking. They just provide the auditors with a report that has been exported, complete with evidence trails.

This is the clear difference between “audit panic” and “audit peace.”

Software Testing for Audit Automation

Now here’s the part that most people overlook:

How do you know for sure that your automation is functioning properly?

Automating controls is one thing, but having full unshaken faith in their smooth operation is quite another. This is where software testing enters the audit-readiness process, and testRigor and similar tools make a world of difference.

The overlap between auditing and testing

- Before release, testers validate functionality.

- After release, auditors validate control integrity.

Compliance issues may emerge when automation fails, even if it does so silently. Continuous testing functions as a safety net.

AI-Powered Test Automation for Audit Assurance

The dynamic systems of today are too complicated for conventional test scripts to manage. They break when business rules or interfaces change. As a result, many organizations are adopting testing automation driven by AI. And testRigor is a prominent solution in this regard.

- Write tests in plain English: does not need coding.

- Validate end-to-end workflows: Simulate real user and control behavior using plain English statements. Your tests can span across platforms (like web, mobile, and desktop) or involve various scenarios testing AI features, 2FA login, emails, and more.

- Generate human-readable test logs: testRigor creates detailed logs of all test runs and subsequent findings, which auditors can understand as complete evidence of control performance.

- Integrate with CI/CD pipelines: This helps to make testing a part of your continuous compliance strategy.

testRigor converts automated testing from a task for developers into an ally for compliance. It confirms that your automation is dependable in addition to being efficient.

Conclusion

The main need for building audit-ready automation is to help auditors, not to replace them. This includes the use of technology to ensure that each selection, transaction, and control can be supported by independent evidence.

Companies that steadfastly include transparency in their core values, from AI-driven testing platforms like testRigor to automation in internal audit, will lead the race.

When you build the systems to be accountable from the get-go, rather than only functional, audit is not the only metric to prove your integrity. You prove it every single day.

Additional Resources:

- Top Mistakes in Software Standards Compliance

- How to Achieve HIPAA Compliance?

- How to Achieve PCI-compliance?

- How to Achieve FedRAMP Compliance?

- How to Achieve SOC 2 Compliance?

- AI Compliance for Software

- How to achieve DORA compliance

| Achieve More Than 90% Test Automation | |

| Step by Step Walkthroughs and Help | |

| 14 Day Free Trial, Cancel Anytime |