How to Do Payments Testing: Ensuring Secure and Seamless Transaction Processing

|

|

When you’re doing testing for your e-commerce platform, subscription-based SaaS service, mobile app, or complex financial ecosystem, regardless of the application you’re testing, payment process reliability and security are necessary! Users today want instant, smooth, and secure payments. Any friction at all, like missed transactions, bad charges, delay or inconsistency in payments, breach of user’s security and privacy issues, can quickly erode trust, ruin your business reputation, and amass regulatory liabilities.

Payments testing is more than just functional because it looks at the security, compliance, UX, integrations, and business logic of financial applications. Here, you’re not just testing whether a feature works; you are making sure money moves accurately, securely, compliantly, and predictably through various interconnected systems.

| Key Takeaways: |

|---|

|

Understanding the Payments Ecosystem

The global payments infrastructure is not a monolith; it’s an architecture of layers of players, including banks, networks, processors, gateways, regulators, payment platforms, identity systems, currency exchanges, and merchant tools. All of these layers have a learning curve. Data needs to move through several players in play, each with their own validation, scoring, fraud detection, regulatory checks, and regional rules.

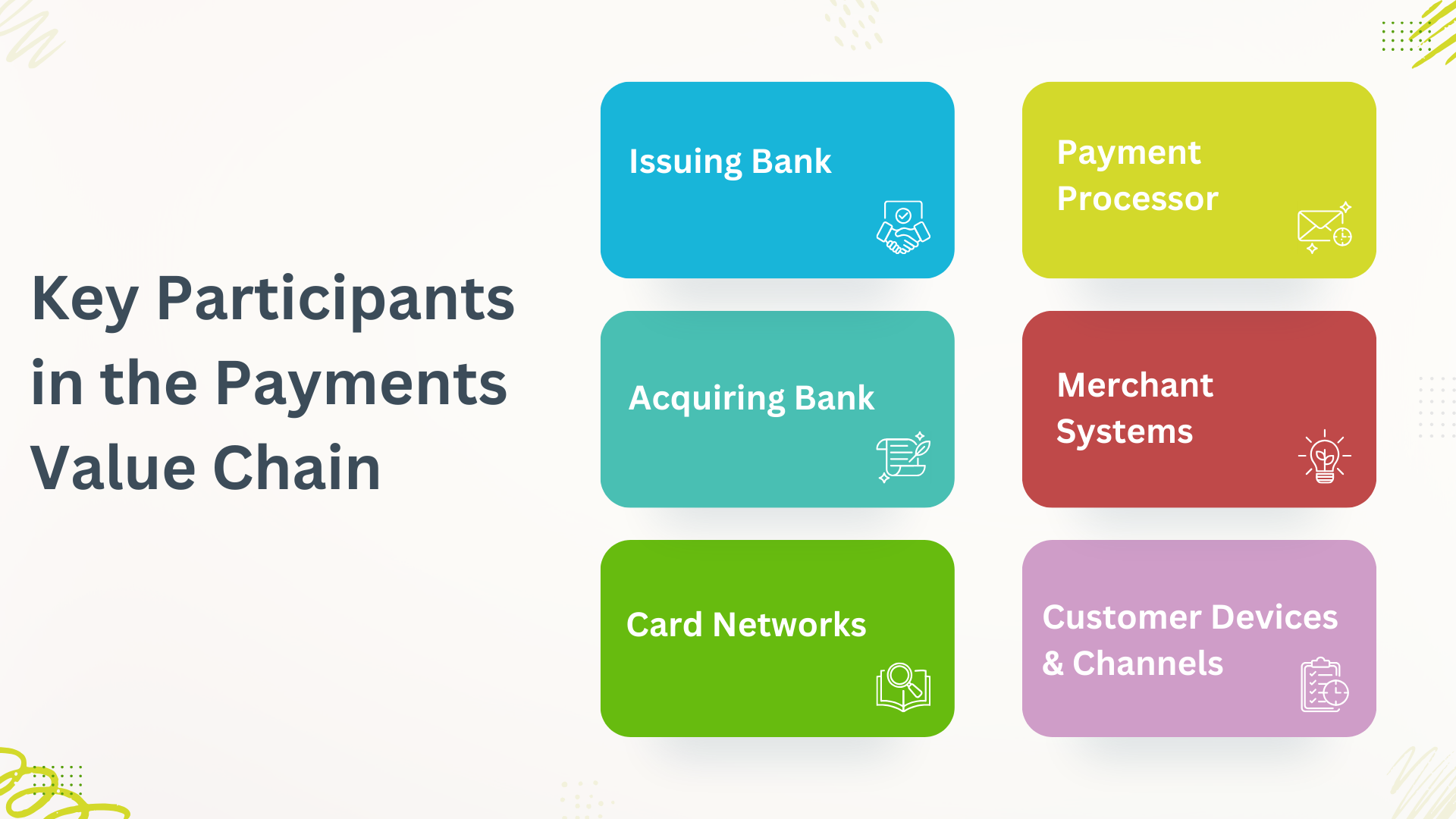

Key Participants in the Payments Value Chain

There are many participants in the payments value chain, and each one is in charge of making sure that transactions go smoothly and safely. To make good QA plans that check real-world payment behavior, you need to know how these players interact with each other.

- Issuing Bank: The customer’s credit or debit card is provided by an issuing bank, which authorizes payment and checks for sufficient funds/credit prior to completing a transaction. QA has to test issuer-specific behaviors like decline codes, fraud checks, authentication flows, and regional authorization rules.

- Acquiring Bank: The acquirer processes transactions for merchants and operates on the receiving end of payment processing. They test for acquirer-side errors, settlement file differences, and that the detail reconciles.

- Card Networks: Card networks such as Visa, Mastercard, RuPay, or Amex are intermediaries that process transactions and apply regional and global regulations. QA teams should be able to simulate network-level events , such as cross-border routing, BIN validation, and fee or regulatory effects.

- Payment Processor: The processor formats, sends, and responds to payment requests with fraud rules and normalization logic. Testing will also need to verify integrations, retry logic, reversals, timeouts, and consistent error translation across issuers.

- Merchant Systems: Merchant infrastructure is comprised of checkout flows, order management, subscription engines, ledgers, and ERP tools. Testing should guarantee consistency of data from UI, backend services, ledgers, and financial reporting.

- Customer Devices & Channels: Payments are generated from web browsers, mobile apps, POS terminals, and IOT/Smart devices. The testing should include device behavior, session integrity, wallet integration, and both online and offline transaction flow.

How Money Really Moves in the Back Channels

Behind every transaction is a stream of requests for authorization, financial clearing, settlement, and ledger updates that move through one or more intermediaries in near real-time, sometimes synchronized, and sometimes not. These flows let testers create and enter test cases that are like real-world ones (that mimic the project’s actual behaviors, timing needs, etc.) and see where their system fails.

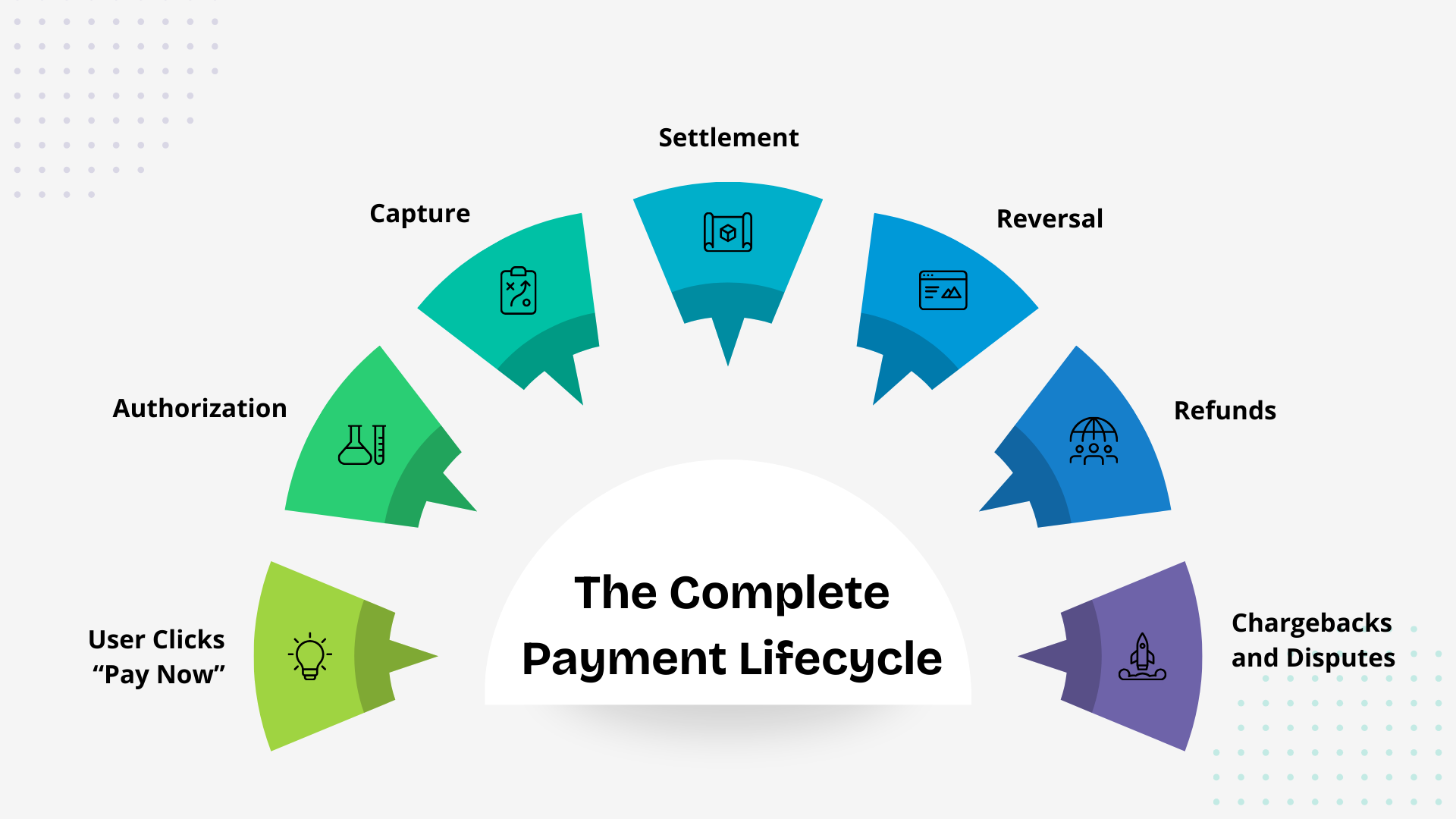

The Complete Payment Lifecycle

Before the money is deposited into a merchant’s account, every digital transaction passes through an organized system of stages. This process could involve authorization, capture, settlement, reversals, refunds, and even disputes. Knowing these stages will enable QA teams to create reasonable test cases that replicate the transaction processing of what happens in actual systems.

When the User Clicks “Pay Now”

When the user enters a payment, the payment gateway captures transaction information and submits an authorization request via card networks to the issuing bank. The status of the response is a key factor in whether a payment can move to capture or settlement. This is why testers need to validate that gateways handle approvals, declines, and network routing correctly. Read How to Automate Add Payment Method Testing

Authorization

Authorization guarantees that the payment information is valid and that there are sufficient funds or credit available. Meanwhile, risk-scoring tools look at transaction patterns to identify possible fraud. Authorization testing should simulate both approvals as well as denial scenarios, such as insufficient funds, expired cards, suspected fraud, etc. Read: How to Automate Pay Bill Testing

Capture

Capture is performed after a successful authorization and indicates that the merchant would like to take (charge) money from the customer’s card. The test must ensure that the system moves funds correctly from the authorized to the captured state. It should also accept partial captures, delayed captures, and state updates that are fixed. Read: How to Automate Check Payment Page Testing

Settlement

Settlement happens when the issuer sends money to the acquirer, and the card network sends the merchant confirmation records. QA has to check the timing of settlements, delays, partial settlements, and currency conversions. It is very important to have accurate reconciliation and reporting validation. Read: How to Automate Denied Payment Testing

Reversal

A reversal permits the merchant to void an authorization before settlement has taken place. The testing process needs to verify that the reversal flows are performed correctly and don’t inadvertently charge fees. Testing should also make sure that the customer isn’t charged twice. Read How to Automate Payment Time-out Testing

Refunds

Refunds happen after a transaction is settled and the merchant reverses the money back to the customer. Tests should cover refunds (full, partial, and multiple partial), and making sure that the ledgers are updated correctly. QA needs to test that both refund receipts and transaction histories correctly reflect these changes. Read: How to Automate Change Payment Method Testing

Chargebacks and Disputes

A chargeback happens when a customer disagrees with the charge on their credit card; it can happen due to fraud, dissatisfaction, or processing errors. Testers need to mimic dispute cases, test fraud alerts, and validate each stage of the chargeback process. It is also critical to verify that ledger recon and balance adjustments are done correctly.

Read: E-Commerce Testing: Ensuring Seamless Shopping Experiences with AI

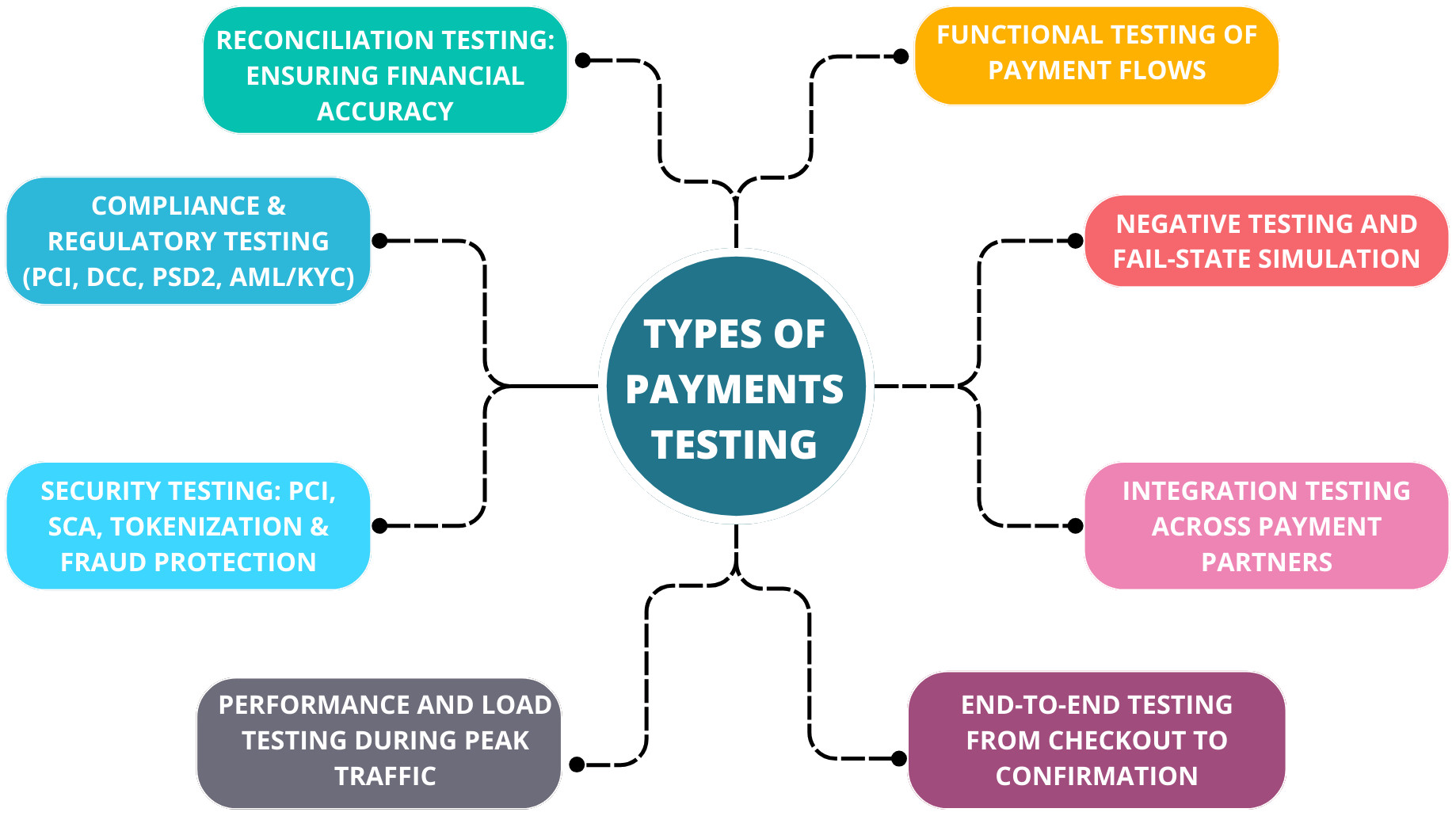

Types of Payments Testing

Payment systems are layered with technology, partners, and a regulatory environment, making it a very specialized test. Every payment type of test is very important so that the transaction can be reliable, secure, and correct. A strong testing strategy allows us to highlight failures early and ensures a quality experience for the merchant and customer.

Functional Testing of Payment Flows

Functional testing ensures that every payment flow, including authorization, capture, reversal, refund, and settlement functions, is exactly as it should be. It makes certain that UI and API interactions work as they should under normal circumstances. QA teams test expected outputs for different payment types, currencies, and transaction kinds.

Negative Testing and Fail-State Simulation

Negative testing examines how the system behaves when something goes wrong, such as failed authorizations, invalid inputs, network outages, and so on. That is why we do the testing to know if our system fails gracefully and informs us with proper error codes and messages. Simulating fail states helps identify weak points that could disrupt real transactions. Read: Positive and Negative Testing: Key Scenarios, Differences, and Best Practices

Integration Testing Across Payment Partners

Integration testing facilitates smooth communication between gateways, processors, card networks, and banks. It checks for proper request format, message routing, retrying, and error handling of all partners. Such testing is very important as most payment failures happen at integration points. Read: Integration Testing: Definition, Types, Tools, and Best Practices

End-to-End Testing from Checkout to Confirmation

E2E testing checks the entire payment process flow, all the way from choosing a product to getting a final payment confirmation. It validates that everything, including checkout UI, backend services, payment partners, and order management, actually works. This testing is utilized by QA teams to verify that customer and merchant record values update properly. Read: End-to-end Testing

Performance and Load Testing During Peak Traffic

Performance testing is used to see how a payment system behaves when it experiences a substantial workload and during peaks. It’s instructive to identify Authorization performance bottlenecks around speed, latency, and throughput. Load testing helps verify system stability during flash sales or holidays. Read: What is Performance Testing: Types and Examples

Security Testing: PCI, SCA, Tokenization & Fraud Protection

Security testing is done to ensure payment systems are compliant with PCI-DSS and processing SCA effectively. It verifies tokenization, encryption, fraud protection methods, and other details. This testing keeps customers safe from data breaches and fraud. Read: Security Testing

Compliance & Regulatory Testing (PCI, DCC, PSD2, AML/KYC)

Compliance testing ensures the payment system is in line with industry regulations globally. This includes PCI-DSS checks, PSD2 rules, Dynamic Currency Conversion, and AML/KYC requirements. This verification helps the platform to maintain within legal standings and lower potential regulatory risks.

Reconciliation Testing: Ensuring Financial Accuracy

Reconciliation testing verifies the transaction amounts tied up between the issuer, acquirer, processor, and merchant systems. It compares ledger accuracy, the rate used to settle a trade, currency exchanges, and even whether reporting was consistent. This test is necessary to avoid money laundering and bookkeeping mistakes.

Payment Methods: In-Depth Testing Across Global Instruments

Payment methods have very different rules, processing flows, and technical behaviors, which makes testing harder than it seems at first. Every method has its own timing limits, risk models, authentication steps, and requirements for each region. QA teams need to check these behaviors carefully on all instruments to make sure that global systems are reliable.

Credit and Debit Cards

Card payments coverage is extensive and involves testing for multiple networks, issuers, locations served, and BIN ranges to ensure that routing and authorization behaviors are correct. Telemetry of tokenization, EMV 3DS authentication, recurring transaction exemptions, cross-border rules, and fallback flows must be verified by QA. Issuer risk scoring, challenges with fraud, and complex decline scenarios also need to be tested. Read: How to Automate Add Credit Card Testing

Digital Wallets

Wallets like Apple Pay, Google Pay, PayPal, AliPay, and WeChat Pay have brought device-based authentication, tokenized PAN, and OS-level security mandates. Testing would need to include biometric prompts, wallet-specific declines, region-based acceptance rules, and app-to-web handoff interactions. These flows need to be validated closely, as each wallet provider imposes its own protocols and risk checks.

Bank Transfers & RTP Systems

Bank transfer systems such as ACH, SEPA, PIX, UPI, PayNow, and Faster Payments have asynchronous updates and multi-stage status flows. QA has to check the pending states, delayed notifications, settlement discrepancies, and transfers that have been interrupted by insufficient balance or user cancellation. For real-time systems, additional checks are required for instant acknowledgments, timeout handling, and fraud controls. Read: How to Automate Transfer Testing

BNPL (Buy Now Pay Later)

BNPL flows rely heavily on upfront credit approval, identity checks, and risk models before completing a transaction. Testing must validate installment schedule creation, handling of missed payments, and the reconciliation differences between user repayments and merchant settlements. QA also ensures that refunds, partial reversals, and split-payment structures behave correctly within the BNPL lifecycle. Read: Automated Testing in the Financial Sector: Challenges and Solutions

Designing a Payments Test Strategy

- Mapping Your Entire Payment Architecture: This is where you document every element, including gateways, processors, issuers, ledgers, and external partners. Being able to easily map back to it would allow testers to locate dependencies, understand how data is flowing through the system, and identify points of potential failure.

- Identifying All Payment Methods & Flows: QA must catalog all supported instruments and pathways, including cards, wallets, bank transfers, and BNPL. This ensures coverage across every flow, variant, and authentication scenario.

- Preparing High-Quality Payment Test Data: Test data must contain valid, invalid, edge case, and regional card numbers, as well as tokenized credentials and bank account profiles. Realistic simulation of user behavior and issuer reaction is made possible by high-quality data.

- Understanding Issuer, Gateway, and Processor Behaviors: Each partner has its own rules, decline pattern, and timing. Testers must anticipate these differences to validate accurate error handling and routing logic.

- Designing Test Environments, Sandboxes, and Mocks: Test safely in their own dedicated test environments for high-risk scenarios or simulating partner behavior without impacting production. By setting this, we can reliably test rare or difficult situations.

- Building a Cross-Functional Testing Framework: A good framework brings together QA, engineering, product, and finance to ensure optimal end-to-end flow testing. Collaboration ensures that both technical and financial accuracy requirements are met.

- Identifying Risk Zones in Payment Systems: Risk zones include fraud checks, cross-border rules, settlement delays, reconciliation mismatches, and asynchronous flows. Highlighting these areas helps prioritize deep testing where failures are most impactful.

Post-Payment Financial Actions

There is no standard process for how a merchant or gateway works with refunds and reversals. Refund testing consists of verifying refund accounting, ledger postings, partial refund rules, and edge case timelines, as well as the issuer-side delays, the refund-post behavior, and the refund-notify sequences. Chargeback testing must cover the verification of dispute states, merchant evidence uploads, representment workflows, and liability shifts according to strict network timelines.

Testing Environments and Payment Simulators

Sandbox cards are offered by payment gateways that simulate issuer response. However, advanced testing means that you have to customize sandboxes and build a case for fraud, cross-border routing discrepancies, unavailability of the network, payout latency, or settlement differences. Manually simulating complex flows is not always easy to reproduce.

How testRigor Supports Payment Testing

Payments testing by nature is complex with multi-party integrations, security implications, compliance considerations, and the sheer number of potential user paths and exceptions. These are problems that traditional automation tools often struggle with – relying on brittle element selectors, requiring a large amount of code, and breaking frequently when UI (or partner dependency) changes.

testRigor, on the other hand, takes a completely different approach to testing payments. It is built to be reliable, stable, and smart like a human, which makes it perfect for checking payment operations that are very sensitive and heavily regulated.

Eliminate Fragile Locators with Human-Language Test Steps

click "Pay Now" enter saved value "Credit Card Number" into "Card Number"

Read: testRigor Locators

Testing Across Web, Mobile, Hybrid, and Native Apps

Payments are taking place on a variety of surfaces, from desktop browsers to in-app purchase screens to mobile web to iOS and Android native checkout screens to companion apps for POS systems.

- Web

- Mobile Web

- Native Android and iOS

- Hybrid apps (such as React Native, Flutter)

This allows QA to now consistently validate browser-based wallets, OTP flows, or in-app subscriptions that are not fragmented across devices.

Support for OTP, MFA, and Authentication Challenges

- SMS OTP (mobile)

- Email OTP

- Push-based authentication

- Phone call validations

Even when the authentication flow temporarily switches apps or loads external pages, testRigor continues execution without losing session continuity.

Wrapping Up

Payments testing is one of the most important and intricate parts of QA, as it confirms that money operates correctly, securely, and safely between a number of overlapping financial institutions. A strong testing strategy across the functional, security, compliance, performance, integration, and reconciliation layers enables organizations to catch failures upfront and maintain user confidence.

Nowadays, with AI-powered tools like testRigor, teams can have much more robust, human-like validation of payment flows across devices, authentication methods , and global payment partners.

| Achieve More Than 90% Test Automation | |

| Step by Step Walkthroughs and Help | |

| 14 Day Free Trial, Cancel Anytime |