How to do Digital Banking Testing?

|

|

In the era of digital transformation, banking is no longer about customers physically visiting one of their branches to conduct transactions, but rather a 24/7 experience that occurs wherever they are. Digital banking is becoming a necessity, not a luxury. Everything from mobile apps, web portals, APIs, and the cloud-based payment infrastructure is now interdependent in a software-driven banking ecosystem.

Digital bank testing has become a specialized science that is deep and wide, beyond the scope of functional verification. Modern-day banking systems are large ecosystems where customer demands, security requirements, and technical architecture come together. Testing digital banking apps means not only grasping what customers see on their screens, but also all the complex layers of middleware, business logic, core banking systems, and third-party integrations that support every single transaction.

| Key Takeaways: |

|---|

|

Understanding Digital Banking

Digital banking is the digitalisation of all the traditional banking activities and programs. It encompasses everything from online account management and transactions to virtual customer service and real-time analytics. It is designed to provide consumers with ease, speed, and transparency while allowing banks to run cost-efficiently.

The Multi-System Architecture

A typical digital banking system includes multiple components. Let’s look into each of them.

- Mobile and Web Applications: These are the main client touch points that provide user-friendly interfaces for making transactions and managing accounts & bank services.

- Core Banking System (CBS): The CBS is deployed as the backbone of technology and plays a pivotal role in processing financial transactions, maintaining customer records, and providing immediate, real-time, up-to-date access to all banking operations.

- Middleware & Service Layers: This interconnecting layer links and brings together the front-end interfaces with backend systems, hovering over APIs, ESB routes, and Microservices orchestrating data traffic to fulfill a smooth interoperability system.

- Payment Systems: These systems facilitate the domestic and cross-border flow of funds, which are processed in a secure manner, while adhering to prescribed settlement instructions and timelines. Read: How to Do Payments Testing.

- KYC/Identity Verification Systems: These solutions verify the identities of customers by cross-checking documents, biometrics, and personal details in onboarding flows and account maintenance activities.

- Risk and Fraud Detection Engines: These engines examine transactional behavior analysis/user behavior to discover new patterns (anomalies), compute risk scores, and block potential fraud. Read: How to Do AML (Anti Money Laundering) Testing.

- Customer Management & Notification Systems: These platforms manage customer communications and service engagements, sending alerts, updates, and promotional campaigns across email, SMS, and in-app channels.

- Third-Party Service Providers: External providers connect and extend the functionality of digital banking with value-added services such as money exchange, digital wallets, and Buy Now Pay Later.

These modules could be produced by separate manufacturers, updated separately in time, and regulated differently. For testing, it is necessary to confirm not only every element but also its coherence with each other.

The Stakes Are High

Digital banking systems have very high stakes because any mistake can hurt customer trust, the integrity of the finances, and compliance with the law.

- Manage real money

- Store sensitive personal data

- Fall under strict government regulations

- Operate 24/7 across millions of transactions

- Must resist cyberattacks targeting financial systems

This raises the bar for testing far beyond what most e-commerce or SaaS apps require. Testing must be fail-proof.

Read: Test Automation for FinTech Applications: Best Practices.

Core Objectives of Digital Banking Testing

When creating or running digital banking tests, the QA team must focus on four major goals: functional accuracy, security and fraud prevention, performance and stability, and compliance at the highest level. These goals guarantee that each digital touchpoint, from routine requests to revenue-generating transactions, remains precise, secure, and reliable under any circumstances.

- Functional Correctness: The system must have the same functionality as we expect. Key flows such as login, account inquiry, transfer of funds, and statement downloads should work correctly at all times, even when things are only partially up.

- Security & Fraud Prevention: Each touchpoint needs to be secure at a variety of devices, session, API, servers, and encryption levels. Authentication and authorization should be resistant to brute-force attacks, credential stuffing, replay attacks, and session hijacking.

- Performance & Resilience: Banks must process transactions with low latency at peak load. They can’t go down on salary-credit days, holiday seasons, tax-filing time or when businesses post financial results for a quarter.

- Regulatory Compliance: Digital banks are required to comply with an extensive set of compliance standards, namely those associated with KYC/AML requirements, PCI-DSS, GDPR, and FFIEC, along with country-specific regulations such as RBI, MAS or the FCA. Read more: AI Compliance for Software.

Testing should validate that workflows and data handling follow these mandatory rules.

Challenges of Online Banking Testing

Testing digital banking apps is different from testing any other type of software. QA teams need to think about:

- Complex Integration Points: What seems like a simple user action has the potential to impact numerous interdependent systems, including mobile UI, API gateway, core banking platform, payment switch, fraud engine, and notification service. With so much dependency on one another, each point of integration becomes a possible reason for failure, which needs to be thoroughly tested.

- Highly Sensitive Test Data: It is not permitted to use production data for compliance reasons. Testers need to simulate masked or synthetic data, while still being as real as banking cases.

- Long Test Flows: A simple ‘Open Account’ flow might include a large number of dependent sub-flows like document upload, biometric verification, OCR extraction, PAN/SSN validation, risk scoring, customer profile creation, and CRM linkage. Each step depends on the previous, so even a minor failure can derail the whole process of bringing someone on board.

- Ever-changing Regulatory Requirements: KYC standards, transaction limits, onboarding guidelines, and even how data should be treated are often updated by regulators. QA must adapt continuously.

- Complex Permission Systems: The role-based access control involves a lot of complexity, as each user type (or customer, teller, auditor, admin) gets a different set of permissions or access rights for the same functionality.

- High Cybersecurity Risk: Banks are at the forefront of high-profile targets for advanced cyber threats because they hold valuable financial data and transactions, making quality assurance teams one of the most crucial front-line security defenses in discovering vulnerabilities before hackers act on them.

The End-to-End Digital Banking Testing Lifecycle

Digital banking is the result of many systems working together, lots of regulations to comply with, and real-time money movement, so the testing lifecycle can’t be more structured and very extensive. All of these phases are important to ensure that any customer transaction (be it a generic balance query or the transfer of a sum of money) actually works perfectly and is secure.

Requirement Understanding in Digital Banking

Before writing a single test case, testing teams must deeply understand:

- Business domain requirements, which include understanding account types, interest calculations, transaction rules, overdraft behaviors, and the complete workflow of loan origination.

- Technical architecture comprehension, including understanding of the mobile app architecture, backend Microservices, API specifications, middleware mappings, and dependencies with all integration points.

- Digital banking user personas that include individual customers, small businesses, corporate clients, bank employees, and auditors.

Each user behaves differently and requires different validation.

Preparing the Test Strategy for Digital Banking

Developing a digital banking test strategy provides a framework for how to perform testing and, at the same time, guarantees that all important elements are accounted for. An effective test plan should describe the scope, types of testing, environments, tools to be used, data required, and quality goals. Here is a Test Strategy Template.

- Scope: The scope outlines the digital banking activities that will be tested for, eg, onboarding, authentication, transfers, payments or account management. It also outlines integrations required, such as core banking, payment gateways, fraud systems, and any third-party services.

- Testing Types: This includes functional, security, API, database, performance, accessibility, regulatory, and an end-to-end test to cover all digital banking workflows and risk.

- Environments: Test environments will include SIT, UAT, pre-production, and production, as a masked environment to test digital banking functionality in a more advanced fashion.

- Data Strategy: This provides details on how realistic test data will be generated and how the masked customer’s information can be securely retained and used across cycles.

- Tools: They may include API testing tools, performance testing frameworks, fraud-testing simulators, and test automation platforms like testRigor that support vision-based UI automation.

Creating the Digital Banking Test Plan

A test plan covers the whole process for validating a digital banking release and confirms that everyone knows what they’re doing. It clarifies the timelines, scope of testing, risks, and coordination across various testing streams.

- Scope: This defines the features or module (such as the mobile app version 6.2) that will be tested in a given release.

- Schedule: The schedule should define the release date, milestones, and regression cycles.

- Roles & Responsibilities: This outlines who is responsible for the API testing, automation, security validation, and integration testing across different teams.

- Risk Assessment: Indicates any potential risks, vulnerabilities, dependencies, or constraints that might affect the test or release’s quality.

Read: QA Roadmap: Test Plan vs. Test Strategy.

Types of Testing Required in Digital Banking

Digital banking requires more types of testing than typical systems.

- Functional Testing: Checks user registration, login, and authentication, account dashboards, fund transfer, bill payments, card management & loan journeys, which are further tested in normal, boundary, and abnormal conditions.

- API Testing: Verifies if the request and response accuracy, idempotency, authentication tokens, and schema validation are working fine with encryption and rate-limiting enforced properly with resilience under failure.

- Performance Testing: Ensures the digital banking system operates reliably under normal load, peak load, stress, and endurance conditions by evaluating metrics such as transactions per second (TPS), latency thresholds, database query performance, and the system’s ability to scale vertically and horizontally.

- Security Testing: Covers vulnerability scanning (such as XSS, SQL injection, CSRF, and clickjacking), authentication attack prevention (including brute force, credential stuffing, and session hijacking), API security checks like token lifecycle and HMAC validation, encryption validation for TLS and data-at-rest protection, fraud behavior simulations for suspicious logins and anomalous transactions, and compliance testing against PCI-DSS, OWASP Top 10, and local banking security standards.

- Data Integrity Testing: Helps in verifying the financial correctness of the application by ensuring that rounding rules, interest calculations, transaction ordering, and ledger consistency follow double-entry accounting principles.

- Database Testing: Validates the master data, customer profiles, transaction logs, audit trails, stored procedures, and triggers in a banking application.

- Usability Testing: Ensures that digital banking applications are easy to understand and navigate for older customers, those with disabilities, or low-tech users, by verifying clear navigation paths, visible flows, consistent UI patterns, and clear layouts.

- Accessibility Testing: Guarantees digital banking apps accommodate all users by verifying compatibility with screen readers, high-contrast modes, keyboard-only navigation, and filter compliance with WCAG 2.2 specifications.

- End-to-End Integration Testing: Verifies the full digital banking flow from account login, across APIs, middleware, and core banking systems, including notifications and UI feedback, is working smoothly.

- Disaster Recovery Testing: This incorporates failover testing to verify that redirection to backup systems is automatic, data synchronization checks to ensure alignment between primary and secondary environments, and RPO/RTO testing designed to confirm that recovery goals are consistent with business and regulatory requirements.

Test Data Strategy for Digital Banking

The test data approach in digital banking is essential as real customer data cannot be used in testing environments due to regulations. Meaning QA teams have to develop safe, representative, and compliant datasets that truly mimic real-life banking simulation on the line.

- Synthetic Data: Includes fake PANs, SSNs, account numbers, and other values that are generated in a way to look exactly like actual financial data without revealing any personal information.

- Masked Production Data: Allows companies to make synthetic (masked) sensitive information like names, account numbers, and identifiers, but still metadata indicative of realistic behavior for testing purposes.

- Scenario-Based Data: Consists of accounts that are set up for different situations like inactive status, NPA type configurations, blocked cards, blacklisted customers, and the threshold-limit cases.

- Negative Data: Designed to cause fraud behaviors, validation errors, and boundary failures to ensure the application operates under a valid set of circumstances.

Read more here: Dynamic Data in Test Automation: Guide to Best Practices.

Test Environment Setup

This must closely resemble production so that tests can be verified with precision and consistency on every system. These are environments with a number of substances paralleling naturalistic banking infrastructures.

- Core Banking Simulator: Allows for controlled tests of monetary transactions without affecting the real system.

- API Gateway: These settings include throttling and routing rules to simulate real production traffic patterns.

- Middleware Services: Middleware components such as ESB, message queues, and Kafka topics replicate the communication flow between distributed services.

- Payment Systems Stubs: Payment stubs simulate NEFT, RTGS, ACH, SEPA, and other payment rails to verify that transaction flows are working properly without having the need to call real networks.

- Device Compatibility Setup: Required to make sure testing across multiple iOS and Android versions for consistent performance of the mobile app.

- Security Certificates: Security certificates such as TLS keys, signing keys, and encryption keys are provisioned to support secure communication and cryptographic operations.

Read: Managing Your Test Environment: What You Need to Know.

Test Execution

Test execution in digital banking adheres to a systematic, step-by-step methodology designed to validate all aspects of a system. This involves running smoke tests for basic sanity checks, comprehensive system and integration tests, regression testing after every release, security checks via penetration and vulnerability scans, and final UAT, where bank staff confirm that the business is working.

Automation in Digital Banking Testing

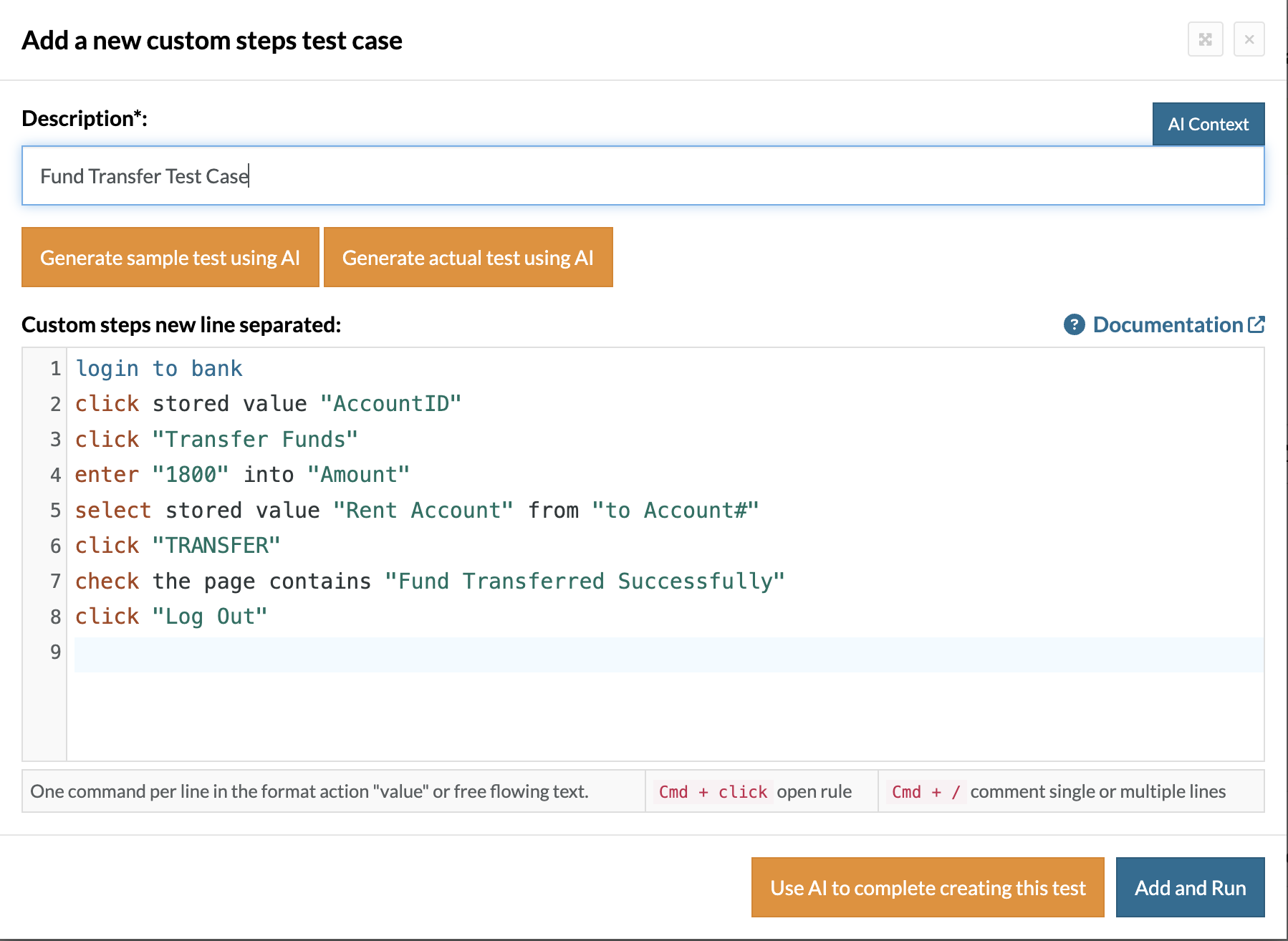

Automation is a critical process in digital banking testing because of the frequent releases, long user flows, complex data variations, and support on different devices and browsers. Using a traditional automation tool won’t be of much help, as it requires more time in maintenance than automating every edge case. testRigor is well-suited due to many of its advanced features.

Let’s look into some of them.

- Gen AI-based: testRigor works on generative AI, so you just need to provide the test case description, and it can generate test cases for you, which helps to save a lot of time that testers can invest in creating more edge cases.

- Natural Language Scripting: With testRigor, even manual testers can create automation scripts in plain English. Thanks to the Natural Language Processing algorithms, these help not just manual testers, but everyone on the team. People without coding knowledge can create or update automation scripts very easily. This helps to increase the automation coverage by automating any edge cases.

- No Flaky Tests: They are mainly caused by the element locator error. It’s common that element properties get changed frequently, and the traditional tools, where whole automation relies on element properties, fail miserably, creating a high magnitude of flaky tests, thereby not giving any proper insight to the product management team. testRigor uses its own ways of identifying the element. Using testRigor, you can specify the element name or its position, and it will identify the element. So, the flakiness reduces to zero, and therefore, maintenance is also minimal. Read: Decrease Test Maintenance Time by 99.5% with testRigor.

- Multi-Device Execution: testRigor is not a framework that works only on mobile; instead, it’s a testing powerhouse that can execute different types of test automation, like web and mobile browser, mobile app, desktop app, API, and even mainframe. Also, it supports execution in cross-browser and cross-device testing, thereby giving full coverage of browsers, operating systems, and devices.

- Integrations: testRigor has seamless integrations with most of the 3rd party applications, like project management tools, test management tools, CI/CD tools, and infra management tools. So, no need to create plugins to integrate; it’s already built.

Let’s see how we can create a few test cases using testRigor.

enter stored value "CustomerID" into "Username" enter stored value "customerPassword" into "Password" Click "LOG IN"

The above will be basic steps, used in every test case. So instead of writing these steps every time, we can create reusable rules.

login to bank click stored value "AccountID"

See, the above login steps changed to one short text, which is the re-usable function. Now, again if you see, we are not calling the actual AccountID value anywhere, we are able to save it as a stored value and use it anywhere in the testcase, thereby giving maximum security to the customer.

login to bank click stored value "AccountID" click "Transfer Funds" enter "1800" into "Amount" select stored value "Rent Account" from "to Account#" click "TRANSFER" check the page contains "Fund Transferred Successfully" click "Log Out"

You can go through other features of testRigor here.

Final Thoughts

Digital banking testing is no longer just a technical validation, but a business risk management discipline that safeguards customer trust, financial soundness, and regulatory adherence in an era of 24/7 connectivity. By validating each layer in the stack from UI through APIs, core banking, payments, security, and failover systems, QA teams ensure that every aspect of digital banking is seamless, resilient, and secure in all situations. Using AI-powered automation platforms, modern banks can develop much higher test coverage, nondeterministic tests, and quicker releases with no quality or security sacrifices.

| Achieve More Than 90% Test Automation | |

| Step by Step Walkthroughs and Help | |

| 14 Day Free Trial, Cancel Anytime |