Automated Testing in the Financial Sector: Challenges and Solutions

|

|

“It’s great that people get together and collaborate, talk about the facts and the analysis, all in the interest of having a great financial system” – Jamie Dimon.

Traditionally, the financial sector has relied on manual testing mainly because of the sensitivity of the data it handles and the limitations of software or programming languages it uses, like mainframe systems. Traditional brick-and-mortar banks have transformed with online platforms and mobile apps that allow customers to check balances, transfer funds, pay bills, and even deposit checks remotely, all without visiting a physical branch.

Gone are the days of solely relying on human financial advisors. Algorithmic tools and robo-advisors use AI and data analysis to provide automated investment advice and portfolio management. Contactless cards, digital wallets, and peer-to-peer (P2P) platforms enable instant and convenient transactions.

All these financial products and services have created a demand for 24/7 uninterrupted, flawless, high-quality performance. For that, more complex and lengthy end-to-end testing needs to be performed. Achieving test coverage with only manual testing is challenging in very short release cycles, necessitating the need for automation testing. However, implementing automation testing is not easy in the financial sector.

Let’s discuss the challenges of implementing automation testing in the BFSI (Banking, Financial Services, and Insurance) industry and how we can solve them.

BFSI’s Need for Test Automation

The financial sector deals with incredibly sensitive matters: customers’ money and data. Financial institutions must adapt quickly to keep pace with innovation and customer demands. Let’s not forget that this sector is one of the most heavily regulated ones, meaning that compliance is of utmost importance. Human errors can cause huge losses in an industry with so much at stake. Hence, you need to automate testing in the financial sector to safeguard the integrity of financial systems, protect sensitive data, and ensure a smooth and secure customer experience.

Manual testing can be ineffective, complex, or time-consuming in many areas. Because of this, organizations have had to move to automated testing. Read Transitioning from Manual to Automated Testing using testRigor.

Let’s understand the factors that make automated testing important for financial companies.

Accuracy and Reliability

In financial applications, many values like calculating the interest, budget, or forecast are arrived at after going through complex or complicated calculations. Doing those calculations manually consumes time, and we can’t rely on it to be correct, as a small human error can make the whole validation wrong.

So, by trusting only manual testing, we cannot ensure the application is working fine. Here, we need automation testing to support us, where we can create tests for all complex calculations using automation scripts. Then, a vast amount of test data is passed to check the calculation thoroughly. Also, the accuracy and reliability of the application increase via automation testing.

Efficiency

For financial applications, new features, and updates are released frequently. So, the testing team must ensure those are adequately tested before releasing them to market; manual testing makes it impossible to cover all the scenarios across various devices and browser combinations. Automation testing comes to the rescue for this issue. We can create different test suites, and based on the release, we can execute the required suites to reduce the testing time and increase the test coverage.

Cost Effectiveness

The cost associated with manual testing is high, as you require more team members to cover the test scenarios. Initially, the setup cost for automation tools was higher as we needed to set up the infrastructure for execution. However, the introduction of many new-generation, cloud-hosted test automation tools like testRigor has eliminated the initial setup cost. Also, for automation tests, creating the test scripts is a one-time effort; after that, we can execute them anytime, 24/7, in parallel, saving enormous time. Read a quick guide to Parallel Testing.

Scalability

As financial institutions grow, the data and features they handle also become gigantic. It’s tough to test those features and data manually. Using automation testing, you handle large volumes of data and complex transaction scenarios, which is not practical using manual testing. Know more here: Test Scalability.

Regulatory Compliance

The financial sector is one of the most heavily regulated industries. Automated testing helps ensure compliance with stringent regulatory requirements by systematically covering all aspects of required testing protocols and generating detailed logs that can be audited.

Risk Reduction

Financial applications often involve high-risk operations impacting extensive money or sensitive customer data. Automation testing helps identify and mitigate risks early in the development cycle, reducing potential costly failures or security breaches. Read more about it in this article, Minimizing Risks: The Impact of Late Bug Detection.

Security Testing

Security is critical in the financial sector. Automated security testing can routinely and systematically test the security features of economic applications, helping to prevent breaches and ensuring that data integrity and confidentiality are maintained.

Improved Customer Experience

Automation testing ensures that financial applications are reliable and secure and meet user expectations for functionality and performance. This leads to higher customer satisfaction and trust.

Data Management and Analytics

Automation facilitates better data management and analytics by efficiently processing and analyzing large volumes of data to extract insights. These insights can inform decision-making, improve services, and tailor products to customer needs.

BFSI Automation Testing Challenges And Solutions

Financial applications are not simply “fill-in-the-blank” forms. They involve complex workflows, calculations, and integrations that can be difficult to replicate perfectly in automated tests. For example, a loan application might require credit checks, income verification, and risk assessments before approval. Automating tests for each individual step might not catch issues arising from the interaction between these steps.

Imagine an automated test designed to verify a stock trading application. The test might successfully simulate buying shares. However, it might struggle to handle a scenario where the stock price fluctuates significantly during the purchase process, triggering complex calculations and potential order rejections based on pre-defined risk parameters.

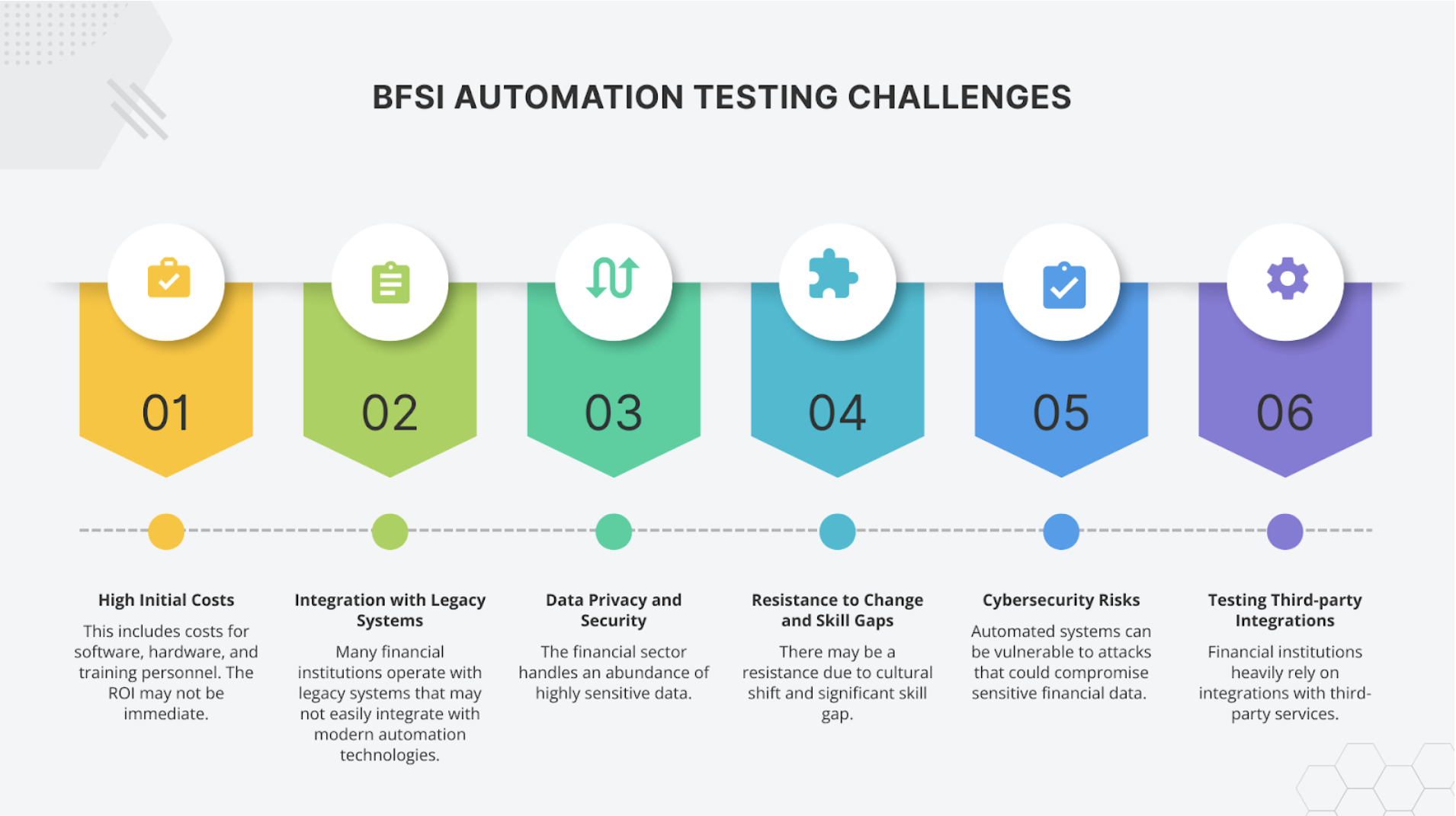

Let us review the automation testing challenges and solutions in the financial sector:

High Initial Costs

- Challenge: The initial investment for implementing automation technologies can be significant. This includes costs for software, hardware, and training personnel. The ROI may not be immediate, requiring financial institutions to plan for long-term gains against short-term expenditures.

- Solution: Tools that require setting up infrastructure and hardware machines consume a lot of time and money. Instead, we prefer cloud-hosted test automation tools. So, you just need to sign up for the subscription, and then you can start creating the test scripts. That tool will take care of the execution environment and infrastructure. Read How to Save Budget on QA.

Integration with Legacy Systems

Imagine a bank relying on a core banking system built in the 1980s on COBOL, a rarely used language today. Automating tests for this system would be challenging due to the lack of readily available testing tools compatible with COBOL. Additionally, modifying the legacy code to introduce hooks for automated testing might be deemed too risky due to the potential for unintended consequences.

- Challenge: Many financial institutions operate with legacy systems that may not easily integrate with modern automation technologies. Updating these systems can be costly and complex, and there’s a risk of disrupting ongoing operations.

- Solution: Choosing an automation tool with less dependency on the application is always good, like dependency on element locators or interacting with the application code. This creates a lot of dependability with the application. So if any change in application or elements causes the test to fail, it’s always better to choose the automation that relies on what’s shown in the UI, the tool that doesn’t depend on element locators. One example is testRigor, which “sees” locators and interacts with the UI as a human would.

Data Privacy and Security

The financial sector handles an abundance of highly sensitive data, including:

- Customer information (names, addresses, Social Security Numbers)

- Account details (account numbers, balances, transaction history)

- Financial instruments (stocks, bonds, loan details)

Balancing the need for realistic test scenarios with the absolute requirement to protect sensitive data presents a unique challenge when implementing automated testing in the financial sector.

- Challenge: Automation involves handling large volumes of sensitive data. Ensuring the security and privacy of this data while automated systems process it is crucial, especially under stringent regulatory standards like GDPR or HIPAA.

- Solution: Automation tools that comply with regulatory compliance, such as SOC2, HIPAA, or DORA, should always be preferred. This gives the customer and management the trust that data will remain secure and that there won’t be any security breaches while using this test automation tool. Read how to achieve AI Compliance for Software.

Resistance to Change

- Challenge: Automation can be met with resistance from employees who fear job displacement or are uncomfortable with new technologies. Managing this cultural shift and aligning staff with new operational modes is a significant challenge for management.

- Solution: As a solution, selecting the right automation tool, which provides built-in integrations and support for different testing types, is good. If the recommended tool can provide built-in integrations and easy test automation steps, the team will prefer to use it. Here is a Test Automation Playbook.

Skill Gaps

- Challenge: There may be a significant skill gap as current employees might not have the technical expertise to implement, manage, and maintain automated systems. This can necessitate substantial training and development or require hiring new staff with the requisite skills, adding to the costs.

- Solution: Many test automation tools, which are programming language dependent, are available in the market. But now the automation tools are more innovative; You can use codeless automation tools, which help the manual testers write automation codes in plain English. There is no need to learn any new programming languages. These tools allow manual testers to create test scripts faster than automation testers.

Read: Codeless Automated Testing: Low Code, No Code Testing Tools.

Cybersecurity Risks

Financial institutions are prime targets for cyberattacks. While automated testing offers numerous benefits, it has limitations when it comes to comprehensive security testing in the financial sector.

Imagine an automated security test designed to scan for SQL injection vulnerabilities, a common attack technique. The test might successfully identify vulnerabilities in forms that allow user input. However, a skilled attacker might exploit a different vulnerability, like a weakness in file uploads, which the automated test wouldn’t necessarily detect.

- Challenge: Automation increases the risk of cyber threats if not managed properly. Automated systems can be vulnerable to attacks that could compromise sensitive financial data. Ensuring robust security measures are in place and up to date is crucial but challenging.

- Solution: Ensure to use a test automation tool that won’t hardcode any test data in their automation script. Also, they won’t use any CSV or JSON files to store test data. These can be security threats. Also, ensure the use of tools with regulatory compliance and that they are not open-source, as anyone can manipulate the test automation source code. Check for more information: Is testRigor secure?

Testing Third-party Integrations

Imagine a bank that uses a third-party credit bureau service to verify loan applicants’ creditworthiness. Automated tests for the loan application process might need to interact with the credit bureau’s API to simulate credit checks. However, limitations in the credit bureau’s API documentation or restrictions on access for testing purposes could hinder the development of effective automated tests.

Challenge: Financial institutions heavily rely on integrations with third-party services to offer a wider range of functionalities and features. The very nature of third-party integrations creates complexities for automated testing, like limited control, dependency, and security considerations.

Solution: Utilize tools that can mock or virtualize the behavior of the third-party system. Leverage specialized API testing tools designed to send automated requests and validate responses from third-party APIs. Prioritize testing the specific interaction points between the financial institution’s system and the third-party service. This allows for targeted automated tests that verify the functionality of the integration itself.

Choosing the Right Automation Tool

There’s a vast array of automated testing tools available, each with its strengths and weaknesses. Choosing the wrong tool can hinder your testing efforts and limit the effectiveness of automation.

Imagine a financial institution looking to automate testing for its mobile banking application. They might choose a popular general-purpose testing tool. However, this tool might not offer specific features for mobile app testing, like gesture recognition or device emulation. This could lead to incomplete test coverage and unidentified issues specific to the mobile platform.

Here are some strategies to ensure you choose the right test automation tool:

- Identify Your Testing Needs: Clearly define your testing objectives and the types of functionalities you want to automate. Focus on areas with high risk or frequent changes.

- Evaluate Tool’s Capabilities: Research available tools and assess their features against your testing needs. Look for tools offering functionalities specific to financial services, like integration testing with core banking systems or regulatory compliance testing frameworks.

- Consider Integration: Ensure the chosen tool integrates seamlessly with your existing infrastructure and development processes. Look for tools offering open APIs and support for relevant programming languages used in your financial systems.

- Security Focus: Prioritize tools with robust security features and a proven track record in the financial sector. Evaluate data encryption capabilities and access control mechanisms to ensure sensitive financial data is protected during testing.

- Proof of Concept: Many vendors offer free trials or demos. Utilize these to test drive potential tools with your specific financial applications and workflows. This hands-on experience can help identify any compatibility issues or limitations before committing to a specific tool.

- Seek Expert Advice: Consider consulting with specialists in financial technology and automated testing. They can provide valuable recommendations based on your specific testing needs and the financial sector landscape.

With all the challenges mentioned, it’s better not to choose any open-source testing tools like Selenium because of the test data security concerns. Selenium has many disadvantages, and we could instead say that Selenium is like an assembly language for automation that uses many complex codes and methods. Selenium depends heavily on the implementation of the application’s elements. With any change in hierarchy, the element identifiers can fail, causing false-positive bugs and loss of trust in automation.

If you are looking for an intelligent, easy to use, and advanced Selenium alternative, you can consider testRigor.

How testRigor Enables BFSI Testing

The Banking, Financial Services, and Insurance (BFSI) industry operates within one of the most complex and regulated technological ecosystems. Applications across core banking, payments, digital banking, anti-money laundering (AML), and wealth management demand reliability, precision, and strict compliance. testRigor provides a powerful, Gen AI-driven, no-code testing platform designed to address these exact challenges with unmatched scalability, reliability, and accuracy.

testRigor is a one-stop testing solution for all kinds of automation testing. testRigor, powered with generative AI capabilities, offers many exciting features aligning with BFSI’s automation requirements. Let us see how.

1. Core Banking Systems

Core banking platforms handle complex processes such as account management, loan management, deposits, withdrawals, interest computation, and transaction reconciliation. testRigor enables end-to-end testing of these systems across web, mobile, API, and mainframe layers using simple natural language commands.

- It supports complex data validations, E2E, and regression testing across interconnected modules like loans, deposits, and general ledger systems.

- By integrating seamlessly with CI/CD pipelines, testRigor ensures faster release cycles while maintaining reliability, even for legacy systems like mainframes.

- Automatically adapts to UI and logic changes using AI-driven self-healing, ensuring stability across frequent updates.

- Provides detailed audit logs and reports, which are vital for compliance audits like SOX and DORA.

login hover over "Payment and Transfer" click "Funds Transfer" select “payee1” from “Select Payee” enter “5000” into "Amount" click radiobutton “SMS” click "Proceed to Pay" verify OTP click “Pay” check that page contains "Payment Successful."

In the above example “verify OTP” is a testRigor’s reusable rule, which is a subroutine or function which can be called in any test just by using its name. Also, testRigor supports 2FA, phone call, SMS testing, here is a detailed guide to know How to do SMS, 2FA, and phone call testing using testRigor?

2. Digital Banking and Customer Experience

Digital banking applications demand flawless user experiences across devices. Any downtime or inconsistency across platforms directly impacts reputation. testRigor enables test creation in plain English, empowering manual testers and business users to validate complex omnichannel workflows such as user onboarding, fund transfers, and KYC verification.

- It automates UI, functional, and accessibility testing across web and mobile apps, ensuring consistent behavior under varying network and device conditions.

- Tests across web, iOS, and Android in a single unified test — no multiple frameworks needed.

- AI-powered self-healing keeps tests stable even as interfaces evolve, bringing the maintenance effort to near-zero. Read: Decrease Test Maintenance Time by 99.5% with testRigor.

login click "Edit Customer" enter "31210" into "Customer ID" click "Submit" click "Phone Number" enter “9384752514" into "Phone Number" click "Submit" check that page contains "Your Phone Number Has Been Updated."

3. Anti-Money Laundering (AML) Systems

AML platforms involve intricate data flows, real-time monitoring, and compliance reporting. testRigor simplifies validation of these systems by supporting:

- Data-intensive test cases for validating transaction monitoring and suspicious activity detection rules.

- Database and API-level testing for accurate data movement between compliance engines and external sources.

- Automatic audit-ready test logs for regulatory verification and traceability.

run SQL query "SELECT CustomerID TransactionID FROM transactions WHERE amount > 100000" enter stored value "CustomerID" into "Customer ID" enter stored value "TransactionID" into "Transaction ID" click "Generate SAR Report" verify that page contains "AML Alert" click “Download SAR Report” check that file "SAR_Report.pdf" was downloaded check that downloaded file "SAR_Report.pdf" contains "AML Alert"

You can easily perform data-driven testing in testRigor, and you can use variables in test cases.

4. Payments Ecosystem

In payment systems, spanning card networks, digital wallets, and cross-border transfers, accuracy and latency are critical. A single bug can result in failed payments or even regulatory violations. testRigor’s cross-platform and cross-browser automation validates end-to-end payment journeys, ensuring that every transaction is processed securely and swiftly.

- Its API testing capabilities can simulate and validate integrations with third-party processors and fraud detection systems.

- SOC 2 Type 2, HIPAA, and PCI-DSS compliant infrastructure guarantees secure handling of sensitive payment data during test execution.

login click "Credit Card" or "Debit Card" click "Block Card" check that page contains "Your Card Has Been Blocked."

5. Wealth Management Platforms

In wealth management, precision in calculations and regulatory compliance are non-negotiable. testRigor ensures the correctness of investments, portfolio rebalancing, and transaction workflows.

- Its end-to-end automation validates integration between trading systems, CRMs, and reporting modules.

- Using testRigor’s Gen AI-based testing, organizations can validate updates to pricing models, risk calculations, or tax rules without reengineering test suites.

- Runs regression suites automatically after every update to ensure ongoing accuracy and compliance.

login click “Mutual Funds” type “ELSS Tax Saver” into “Search a fund” enter enter click “One Time” enter “500000” into “Amount” click “Place Order” check that page contains "Your Mutual Fund Order Has Been Placed."

6. Compliance, Security, and Scalability Across BFSI

testRigor’s compliance with SOC 2, HIPAA, and FDA 21 CFR Part 11 ensures that financial institutions maintain data integrity and privacy. The platform’s cloud-hosted scalability enables thousands of concurrent test executions, ideal for global BFSI enterprises with extensive product portfolios. Its integration ecosystem—including CI/CD tools (Jenkins, CircleCI, etc.), test management suites (TestRail, Zephyr, etc.), and defect tracking systems — ensures testing is tightly aligned with DevOps and release processes.

Let’s look at the valuable features of testRigor.

- Cloud-hosted: testRigor eliminates the need for companies to invest in setting up and maintaining their own test automation infrastructure and device cloud. This translates to significant savings in time, effort, and cost. Once teams are signed in and subscribed, they can start testing immediately. Here is an All-Inclusive Guide to Test Case Creation in testRigor.

- Free from Coding Requirements: While using testRigor, we don’t have to worry about knowing any programming languages. Yes, testRigor helps create end-to-end test scripts in plain English. This advantage helps manual testers immensely, which is why it is an automation testing tool for manual testers. They can create and execute test scripts three times faster than other tools. Also, any stakeholder can add or update natural language test scripts, which are easy to read, maintain, and understand.

- Compliance: testRigor is SOC2 and HIPAA compliant and supports FDA 21 CFR Part 11 reporting. So you can very well trust testRigor and leave the worry aside about security concerns and data breach issues.

- Scalability: testRigor supports the simultaneous execution of test scripts in multiple browsers and devices for different sessions. Also, testRigor has its device cloud, where we can execute test cases on physical devices connected to the cloud. We don’t need to depend on any third-party cloud providers.

- Integrations: testRigor offers built-in integrations with popular CI/CD tools like Jenkins and CircleCI, test management systems like Zephyr and TestRail, defect tracking solutions like Jira and Pivotal Tracker, infrastructure providers like AWS and Azure, and communication tools like Slack and Microsoft Teams. So, there is no need to worry about manually adding third-party integration packages.

- One Tool For All Testing Types: testRigor performs more than just web automation. It can be used for:

Conclusion

Financial applications’ complexities, stringent regulatory requirements, and the ever-evolving threat landscape pose significant challenges. By acknowledging these challenges and implementing appropriate solutions, financial institutions can effectively leverage automated testing. Choosing the right tools, focusing on security best practices, and adapting testing strategies to meet regulatory demands are all crucial aspects of a successful automation journey. Ultimately, automated testing is not a silver bullet but a valuable tool in the financial sector’s arsenal for ensuring accuracy, security, and reliability.

Innovative testing tools like testRigor can play a vital role by ensuring comprehensive coverage and adherence to compliance standards. By overcoming these hurdles and leveraging the right solutions, financial institutions can unlock the true potential of automated testing, achieving faster development cycles, improved software quality, and, ultimately, a more secure and reliable financial ecosystem.

Additional resources

- Software Testing for All Industries

- How to Achieve PCI-compliance?

- How to Achieve FedRAMP Compliance?

- How to Achieve SOC 2 Compliance?

- How to achieve DORA compliance

- How to Build an ADA-compliant App

- Optimizing Software Testing with Effective Test Data Management Tools

- Test Automation Frameworks: Everything You Need to Know

- Choosing Among Popular Test Automation Frameworks: A Guide

Frequently Asked Questions (FAQs)

What is automated testing in the financial sector?

Automated testing in the financial sector refers to the use of software tools to perform predefined tests on financial software systems to ensure they function correctly and meet specified requirements. This includes testing of transaction processing, security, data integrity, and user experience.

Can automated testing completely replace manual testing in the financial sector?

While automated testing is invaluable for handling repetitive and data-intensive tests, manual testing is still crucial for areas requiring human judgment, such as user experience and complex decision-making scenarios. A hybrid approach often yields the best results.

What trends are shaping automated testing in the financial sector?

Trends that you will see influencing the financial sector include the increasing use of AI and machine learning for test case generation and optimization, the integration of blockchain for security processes, and the growing adoption of robotic process automation (RPA) for routine testing tasks.

What are the popular financial platforms that I can test via testRigor?

You can test MyBanco, BankPoint, FinancialForce, FinCell, Oracle Financials Cloud, Mifos X, and almost every financial platform using testRigor. Using plain English, it effectively supports testing cross-platform, cross-browser, parallel, web, mobile, desktop, API, database, and many more complex scenarios.

Is it possible to alter cookies or Manage Session values with testRigor?

Yes, with testRigor, you can easily access and manage cookies or session values. Please check this link to learn more about it.

| Achieve More Than 90% Test Automation | |

| Step by Step Walkthroughs and Help | |

| 14 Day Free Trial, Cancel Anytime |